Master of Science in Accounting

The Master of Science in Accounting (M.S.A.) program at Saint Martin's provides students with professional knowledge of complex topics in accounting, tax, audit, business and ethics. Courses will emphasize understanding and application of accounting principles and theories, incorporate professional ethics and support professional certification.

Jump to

Why Saint Martin's University?

- All classes are offered in the evening to accommodate working students, and some may be offered online

- The program consists of 30 semester credits and can be completed in 12 months

- The program operates year-round

- Identify and research accounting principles and theories

- Critically analyze and interpret accounting data

- Become proficient in using accounting tools to make business decisions

- Present information in professional written and oral communications

Rolling admission and priority deadlines

The M.S.A. program operates on a semester basis with several MBA courses offered during an 8-week term. Applications are accepted on a rolling basis and follow each semester's priority deadline.

Priority deadlines for applications

Students can start the program in fall, spring or summer. The following are priority deadlines for application for each of the five starting terms.

| Term | Priority deadline |

|---|---|

| Fall | July 15 |

| Spring | December 1 |

| Summer | April 1 |

Federal aid & graduate assistantships

Federal aid

Federal financial aid is available for graduate students who will be enrolled at least half time and are citizens, or eligible non-citizens, of the USA. Most federal aid for graduate students is in the form of direct loans.

For more details about federal aid eligibility and the different types of aid available for graduate and professional studies visit studentaid.gov.

Graduate assistantships

Saint Martin’s University offers a limited number of graduate assistantships to graduate students. Contact your graduate program director for more information.

Master of Science in Accounting Requirements

In order to be considered for full and unconditional admission* into the program, applicants must meet the following requirements:

- Applicants must meet all of the School of Business requirements for unconditional admission to a graduate program plus one of the following program specific requirements:

- Bachelor's degree in Accounting; or

- Completion of a Bachelor's degree in Business with undergraduate accounting courses in Intermediate Accounting I and II, Cost Accounting, Audit, and Taxation; or

- A Bachelor's degree in a non-Accounting or Business field and completion of the SMU MBA 500 series or comparable undergraduate coursework and undergraduate accounting courses in Intermediate Accounting I and II, Cost Accounting, Audit, and Taxation.

- Overall 2.75 undergraduate GPA.

- Demonstration of strong analytic, problem solving and writing skills as evidenced by previous coursework, resume and admissions essay.

* Students not meeting these requirements will be considered for conditional admission. Saint Martin's University recognizes that while previous performance is a valuable indicator of potential success, there are those who have demonstrated that potential in other ways than traditional academic performance.

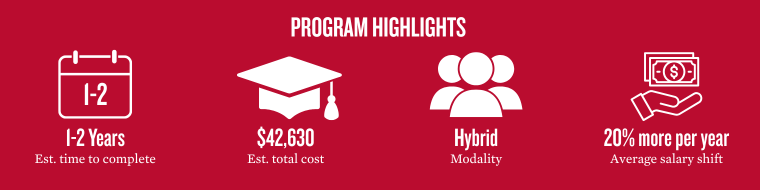

The program consists of 30 semester credits (10 courses) and can be completed in 12 months by taking four (4) courses per term. The official, most up-to-date class offerings can be found by using Self-Service or the Graduate Academic Catalog. For significant term dates refer to the Academic Calendar.

- 0-15 credit hours of prerequisite courses

- 12 credit hours of Accounting CORE requirements

- 6 credit hours of Accounting elective courses

- 6 credit hours of MBA requirements

- 6 credit hours of MBA elective courses

Leveling courses if pre-requisites are not met through undergrad degree:

- MBA 500: Survey of Economics

- MBA 501: Survey of Accounting

- MBA 502: Survey of Finance

- MBA 503: Survey of Management and Marketing

- MBA 504: Quantitative Methods for Management

- Undergrad coursework in Intermediate Accounting I & II (ACC 301 & 302)

- Undergrad coursework in Cost Accounting (ACC 353)

- Undergrad coursework in Audit (ACC 450)

- Undergrad coursework in Taxation (ACC 351 or ACC 352)

Required courses:

- ACC 603: Strategic Cost Management (16 weeks)

- ACC 630: Financial Modeling (16 weeks)

- ACC 664: Financial Statement Analysis for Decision Making and Valuation (16 weeks)

- ACC 667: Internal Audit (16 weeks)

- ACC 668: Taxation of Business (16 weeks)

- MBA 605: Business Analytics (8 weeks)

- MBA 625: International Management (8 weeks)

- MBA 661: Commercial Law (8 weeks)

Electives | Choose 2:

- ACC 613: Accounting Internship

- ACC 628: Investment Analysis and Portfolio Management (16 weeks)

- ACC 660: Fraud Examination (16 weeks)

- ACC 662: Research and Communication (16 weeks)

- ACC 695: Special Topics (16 weeks)

- MBA 602: Financial Planning & Control (8 weeks)

- MBA 630: Entrepreneurship (8 weeks)

- MBA 631: Operations Management (8 weeks)

- MBA 635: Risk Management (16 weeks)

- MBA 640: Project Management (8 weeks)

- MBA 670: Leadership & Change (8 weeks)

Master of Science in Accounting at a Glance

- Degree

- Master

- Master (4+1)

- Program Type

- 4+1 Accelerated

- Master’s Degree

- Campus

- Main (Lacey)

- Type of Instruction

- In Person

- School

- School of Business

- Resources

- Master's in Accounting database

Community

Community